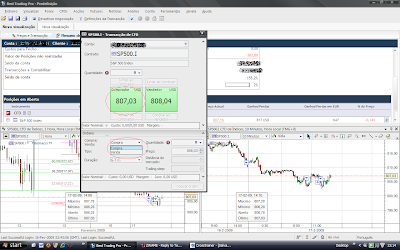

Down move is almost done. This last selling pressure, should be the last one before a medium-term bottom on the market for at least the next 9 months. It may even extend to go into a full year although we should be conservative at first on the targets.

1000-1200 pts on the S&P look like obvious area for a target, where I fall mostly into the mid-rage as more likely around 1091 points on the S&P.

Two or three more weeks and it's time to go on a shopping spree. It's been pretty much a party for bears for 2 years now. It's time for us bears to enter into hibernation mode.

Lots of signs of exhaustion to the downside support the idea of a lasting bottom to occur in the short term. Lot of market divergences are popping up.

Friday, February 27, 2009

Friday, February 20, 2009

Thursday, February 19, 2009

Wednesday, February 18, 2009

Tuesday, February 17, 2009

Saturday, February 14, 2009

Friday, February 13, 2009

Thursday, February 12, 2009

Wednesday, February 11, 2009

Thursday, February 5, 2009

Wednesday, February 4, 2009

Subscribe to:

Posts (Atom)

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com